Why care about engaging customers at a bank? Well, banks today are faced with increasing competition from other financial institutions, the rapid pace of technological advancements, and the changing preferences of customers. Plus, the reality is that most banks profit from only a small subset of their users – there is a large percentage of users that have signed up, but are passive (not engaging on the platform or making trades).

Today, it is crucial for banks to offer innovative solutions to both attract and retain existing customers. Here is our take on four ways a bank can increase user engagement:

1. Offer interactive, personalized digital tools

A strong omnichannel, digital presence that is both personal and interactive is key for banks to win and keep market share today. How to do this? Banks can develop budgeting apps, financial planning calculators, and dashboards with personalized guidance. Plus, in-app messaging, dynamic newsletters, and push notifications means that customers get information on the specific issues that are most important to them. Banks can also use these features to keep users up to date about account privileges, financial offers, new product launches, app updates, and other announcements.

There are many B2C and B2B fintech players in this space, so we would recommend first deciding what kind of tools your bank lacks and then diving deeper.

Parqet is a software to help investors identify risks, recognize trends, and track wealth development. It combines numerous visualizations, facts, history, and key figures of one’s portfolio in a dashboard. No matter what investment strategy one pursues, the company provides the necessary visualizations and tools for maximum transparency into wealth creation.

Simply Wall St equips individual investors with the processes and tools to stick to the principles and succeed. The company gives stock reports, investing ideas, portfolio trackers, market analyses, and more.

2. Empower users with financial education

Many retail investors don’t have a professional financial education – banks have the opportunity to help customers become smarter investors with financial news, investing ideas, opportunities, and analyses. Whether it is providing access to expert investors, assistance with finance lingo, or a library of trusted educational content, there are many companies on a mission to spread financial literacy.

Zogo, trusted by over 200 financial institutions, offers a suite of innovative financial products to improve bank users’ financial literacy and enhance customer loyalty. Similar to Duolingo, Zogo encourages users to have fun while they learn, offering 800+ professionally verified educational modules that deliver information in a clear and compelling way.

Finimize provides financial news and education with a library of trusted content that users actually want to engage with. From outlooks on the housing market to Target’s last quarter earnings, the company is providing digestible content for the everyday investor. This pays off – the company notes that 56% of consumers with financial education become relationship customers and customers with financial education are 2X less likely to switch services.

Another player in the space is Real Vision, an on-demand channel for finance and investing. Real Vision provides interviews with expert investors and analysts, applied learning with interactive discussions and AI support, daily market analysis, video summaries of finance terms, charting tools and economic data, and more.

In addition to curated educational content, there are companies like Quartr that aggregate qualitative public market research. Quartr gives investors worldwide easy access to first-party information from 9K+ public companies. Users can make aggregated searches across its entire database of slides, transcripts, and filings, or pinpoint exactly what you are looking for using custom filters.

While the companies above are more generalist, there are also ones that specialize in a specific subset of retail investors. Ellevest is a robo-advisor investment platform and financial literacy program built primarily for women. And Greenlight is on a mission to empower the next generation by teaching responsible spending habits and money management to kids.

3. Foster a community by connecting customers

Humans are inherently social beings and most investors are followers – not leaders. By introducing initiatives such as promoting events, building online forums, or adding portfolio sharing, banks can foster a sense of community where customers can connect, learn, and share experiences.

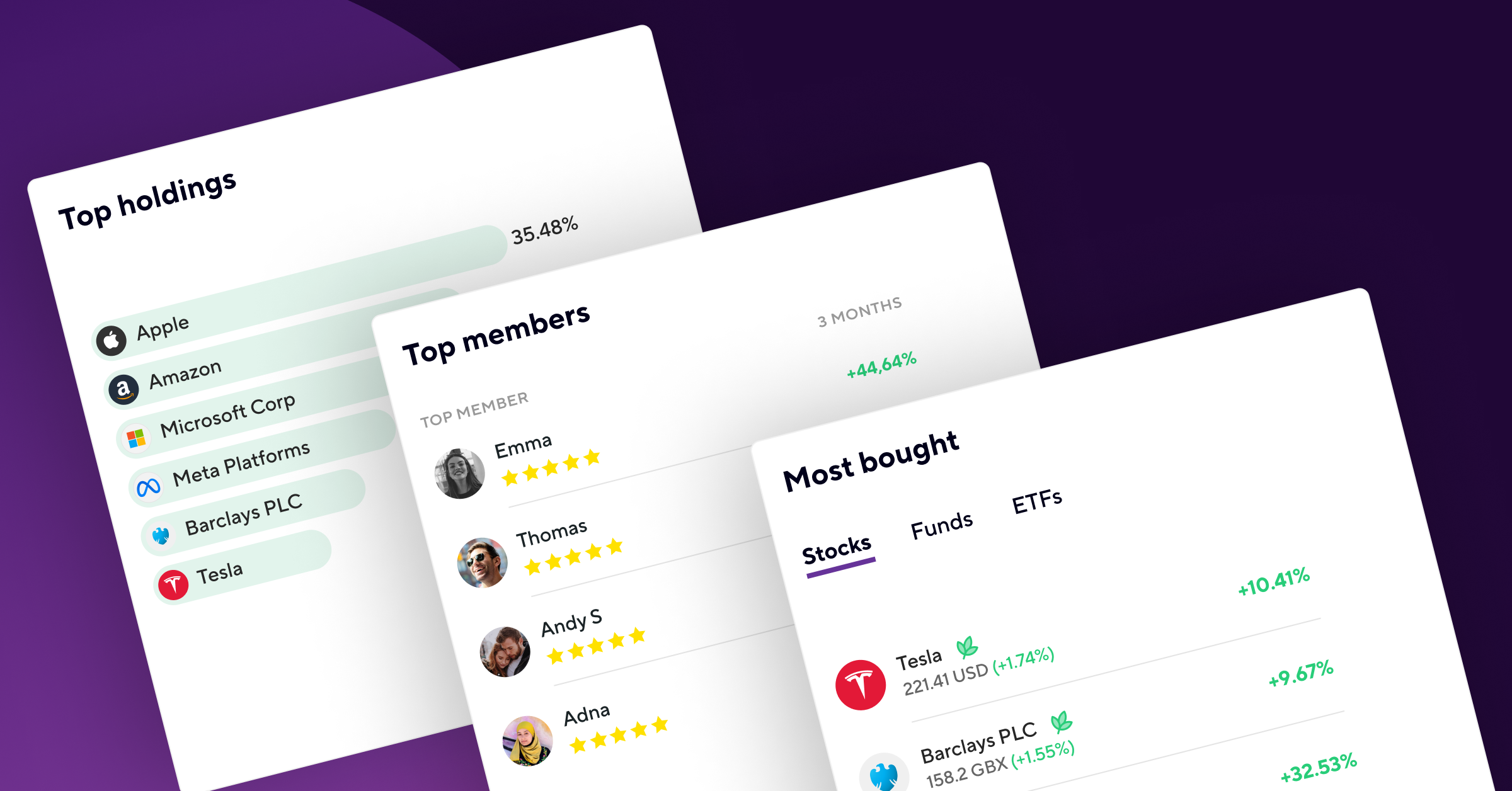

We’re biased towards this point as StockRepublic offers social investing features for banks. We provide anonymous portfolio sharing, benchmarking, real-time user interactions, risk/diversity/climate ratings, and much more. We work with big and small banks all across the world and help them activate, engage, and grow their user bases. Our app is engaging (users spend 2X longer on it compared to other financial apps) and it works (we have increased transactions by +20% and grown a customer’s user base by 25%).

While StockRepublic is the only B2B provider of social investing features, there are of course other ways investors can build community and make investing social. Amity is a generalist software that allows companies to integrate social functions into their apps easily. Its SDKs can be applied to many industries such as health & wellness, retail, media, and sports.

And let us not forget that for years, retail investors have already taken to community platforms and social networks like Discord, Reddit, and Facebook to discuss their niche trading interests and speculations on the market. (Many are familiar with WallStreetBets, a 10+ year old popular sub-Reddit forum where participants actively discuss stock and option trading.) The idea of discussing investing habits with others is nothing new, but the opportunity to give that to users in a bank directly is!

4. Introduce loyalty programs & rewards

By offering tangible benefits for continued engagement (such as exclusive offers, personalized rewards, and access to premium services), banks can incentivize loyalty and encourage active participation. Design loyalty programs that offer real value to customers, such as higher interest rates on savings, lower fees, or access to exclusive financial advice. Other ideas include loyalty points on each transaction, cashback on specific banking services, and referral programs for recruiting new customers.

These offers will have to be tailored by and approved for the financial sector, but for some ideas, look to customer loyalty software companies like Zendesk and Kangaroo. Through customer loyalty programs and CX-enhancing features, like omnichannel capabilities, consumers are inclined to make repeat purchases, providing the perfect opportunity to develop relationships and build customer loyalty.

Loyalty software can also be fun. Gamifiera is a Swedish startup helping companies focus on authentic communication through a range of innovative tools such as reviews, UGC creation tools, gamification, and 3D avatars to help cultivate a vibrant community of brand advocates.

In Conclusion

Today, there are a plethora of options that banks can take to modernize their platforms. We believe the four listed above are the best options to improve customer engagement. Investing in a more robust digital experience and creating a personalized environment that actively engages customers will benefit a bank financially – from acquiring new customers to increasing the activity of existing ones.